The PFR Team

📅 Schedule an Appointment

Need personalized support? Our program specialists are here to help! Fill out our quick online form to request an appointment at a time that works for you.

🔗 Request an Appointment

Overview

The Personal Financial Readiness (PFR) Program is a comprehensive initiative designed to equip individuals with the knowledge and skills needed to manage their finances effectively. It encompasses various educational resources, workshops, and counseling services to address key aspects of personal finance, including budgeting, saving, investing, and debt management. The program aims to enhance participants’ financial literacy and empower them to make informed decisions to achieve their short-term and long-term financial goals. Whether it’s navigating the complexities of taxes, understanding credit, or planning for retirement, the Personal Financial Readiness Program strives to foster financial well-being and resilience among its participants.

Program Components

The first component of the Personal Financial Readiness (PFR) program focuses on education and training, providing military personnel and their families with a solid foundation in financial literacy. Through workshops, seminars, and accessible resources, individuals learn essential skills such as budgeting, saving, investing, and understanding financial instruments. This educational initiative aims to empower service members to make informed and responsible financial decisions throughout their military careers and into civilian life, fostering a culture of financial competence and stability.

The second component of the PFR program centers on personalized counseling and assistance. Through one-on-one financial counseling sessions, trained experts address individual financial challenges, offering guidance on debt management, credit improvement, and other specific concerns. This tailored approach ensures that military personnel receive targeted support based on their unique circumstances, promoting proactive financial decision-making and helping them navigate the complexities of their financial journey with confidence.

The third component of the PFR program involves proactive outreach and comprehensive support services. Through various channels such as online platforms, community workshops, and partnerships with financial institutions, the program actively engages with military communities. This outreach provides valuable resources, tools, and information to foster ongoing financial success. By creating a supportive ecosystem and facilitating access to relevant financial services, the program aims to strengthen the financial resilience of military personnel and their families, ensuring they have the necessary support to navigate their financial challenges effectively.

🔄 The 14 Financial Touchpoints (with FAQs)

Learn the basics of pay, savings, banking, and avoiding scams. It’s your foundation for future financial health. 💪

📌 Tip: Start a budget and open a savings account!

Create a realistic budget, understand BAH/BAS, and review your LES carefully.

📌 Tip: Ask about moving entitlements and allowances!

Avoid lifestyle inflation! Use extra income to pay down debt or build savings.

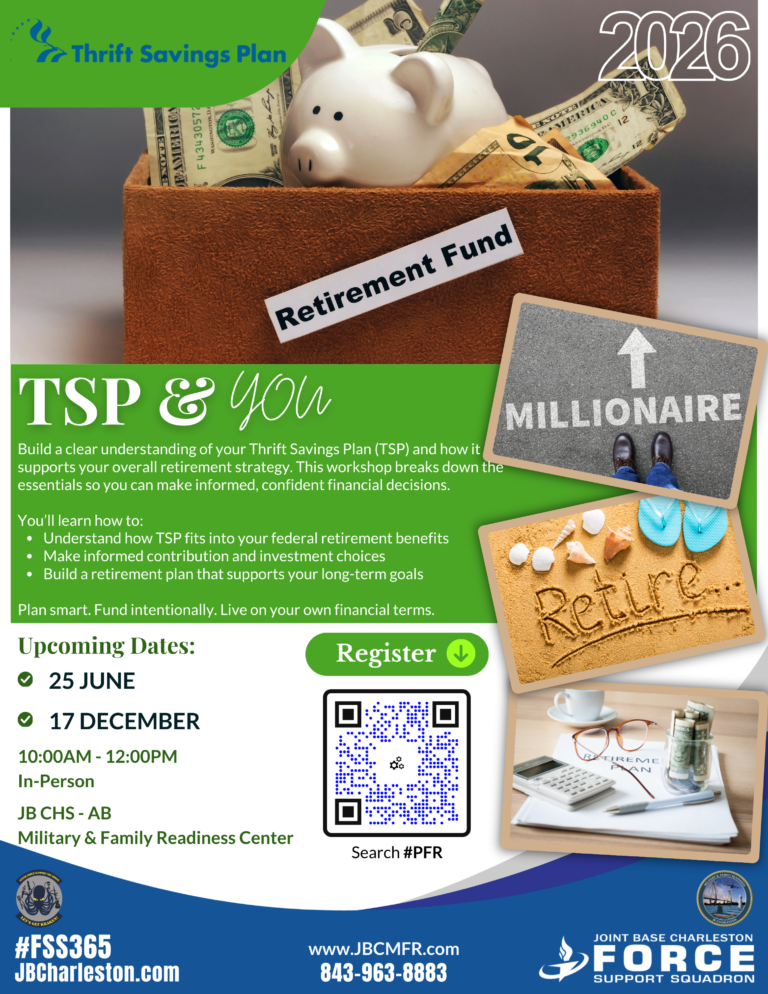

📌 Tip: Consider increasing your TSP contributions.

Marriage impacts taxes, housing, and insurance. Combine finances thoughtfully and update your DEERS info!

📌 Tip: Build a shared budget with your spouse.

Budget for medical bills, childcare, and supplies. Update SGLI, DEERS, and wills.

📌 Tip: Look into the Family Subsistence Supplemental Allowance (FSSA).

Revisit your budget, update beneficiary designations, and review legal agreements.

📌 Tip: Get free legal and financial counseling on base.

Plan ahead! Know your entitlements, make a spending plan, and save receipts.

📌 Tip: Use the PCS Budget Worksheet available at your M&FRC.

Set up allotments, review insurance, and give a trusted person financial POA.

📌 Tip: Save extra income from deployment entitlements!

Reevaluate your budget, pay off debt, and save any leftover deployment income.

📌 Tip: Don’t rush into big purchases!

Have an emergency fund, review insurance coverage, and know your medical entitlements.

📌 Tip: Reach out to a PFC for planning help and benefit navigation.

Create a civilian budget, understand separation entitlements, and attend TAP.

📌 Tip: Review VA disability, TSP options, and SBP decisions.

Seek grief support and help with survivor benefits. Update your records.

📌 Tip: Talk to a CAR/CACO and request a financial counseling referral.

Explore SGLI, VA disability, SSDI, and your base’s EFMP office.

📌 Tip: Build a plan for long-term financial care with a PFC.

Plan ahead for unemployment, update your resume, and tap into transition benefits.

📌 Tip: See a TAP counselor and financial advisor ASAP.

💰 Financial Assistance

Offers emergency assistance, education support, and community programs to Airmen and Guardians.

🔗 Learn More

Provides interest-free loans and grants for emergencies, education, and basic living expenses.

🔗 Learn More

Supports Coast Guard families with emergency loans, grants, and special programs.

🔗 Learn More

Helps Soldiers and their families with financial assistance for rent, utilities, PCS, and more.

🔗 Learn More

Learn about all branch-specific relief organizations in one place.

🔗 Learn More

🌎 Universal Military Financial Resources

Works with service relief societies to provide 24/7 emergency financial help anywhere in the world.

🔗 Learn More

Provides short-term financial assistance and long-term support for military families in need.

🔗 Learn More

Assists post-9/11 veterans, service members, and families facing financial hardship.

🔗 Learn More

Grants up to $1,500 for qualifying military families to help with basic life needs during financial crises.

🔗 Learn More

Service Resources

Other Resources

Click on the images below to learn more.

CFPB – Budget for Servicemembers and Veterans

Office of Financial Readiness (FINRED)

FINRED – Spending Plan Worksheet

FINRED – Financial Well-Being Assessment

Consumer Financial Protection Bureau (CFPB)

Federal Trade Commission (FTC)

FINRED – Understanding Consumer Protections

CFPB – Your Money, Your Goals: A Financial Empowerment Toolkit

MilLife Guide – Controlling Debt

US Dept. of Education – College Affordability and Transparency Center

Military Consumer – Buying a Home

Military Consumer – Renting an Apartment or House

MilLife Guide – Housing & Living

Smart Asset – Mortgage Calculator

FINRED – Knowing Your Benefits and Entitlements

FINRED – Sen$e Financial Education App

Military Compensation and Financial Readiness

Cookie Consent

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

This website uses cookies

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

You can find more information in our Cookie Policy and .